Another problem arises when different departments use varying systems, creating inconsistencies in how data is recorded. Whereas spreadsheets are a great starting point, using software program designed for growing older reports can prevent important effort and time. There are many options out there, from easy free tools to more robust paid Taskade is one example of a user-friendly choice that can assist teams handle duties and monitor progress. For scheduling and automating reminders, discover instruments like Bookafy, which presents both free and paid plans. Consider scheduling a demo with HubiFi to discuss how our automated options can streamline your income recognition process.

They might indicate points in cash flow management or provider relationships. Frequently reviewing the report helps companies plan their cash move more effectively, making certain they have sufficient funds to satisfy their fee obligations. Nonetheless, using accounting or accounts payable software like Volopay to automate your processes could make managing your stories easier.

- It’s essential for managing cash flow, sustaining vendor relationships, and making ready for audits.

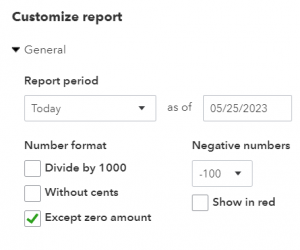

- Modern accounting software program can simplify the creation of Accounts Payable Growing Older Reports.

- Regularly creating and reviewing your aging schedule permits you to proactively handle cash circulate and keep on high of customer funds.

- HubiFi’s integrations may help streamline this course of, preserving your data accurate and up-to-date.

See how forward-thinking finance teams are future-proofing their organizations via AP automation.

Sometimes you might buy products on credit which leads to several transactions with the same vendor. Example- Vendor ABC company requested the CDE company to pay an bill within 30 days and offered two percent low cost if the CDE firm pays inside 15 days. Study extra about how Ramp’s AP automation software has teams doing a month’s value of AP in minutes. There are a quantity of benefits for organizations leveraging the AP growing older report. AP Growing Older Stories provide insights into your spending patterns, highlighting reliance on credit and opportunities for better phrases. This data is crucial for budgeting and long-term monetary planning.

What’s Accounts Payable Automation?

Ramp’s fashionable accounts payable software program allows you to see all of your most essential AP metrics in a single dashboard—plus a whole lot extra. It’s necessary to note that an AP growing older report doesn’t explicitly show your cost phrases with every vendor. You can clearly see when bills are overdue however not when late cost fees or interest will be assessed.

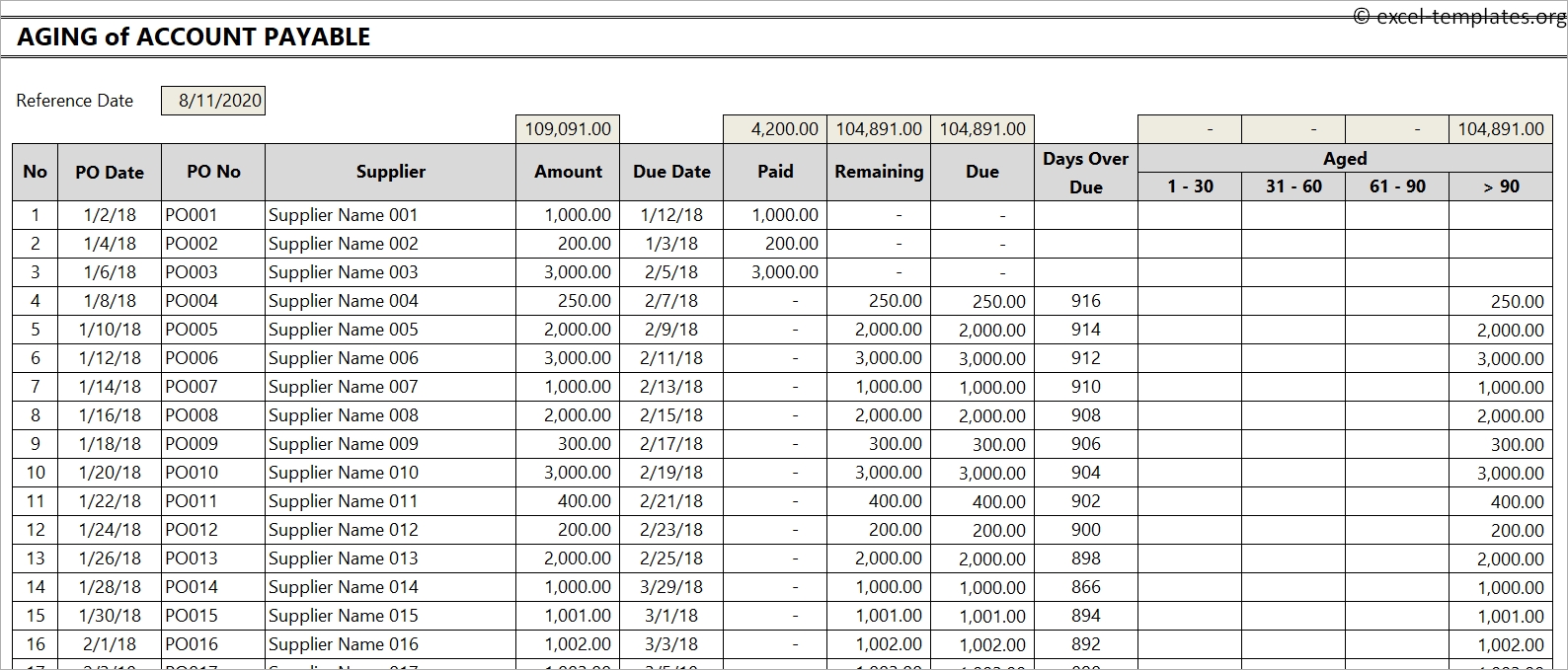

Keep And Leverage Your Getting Older Schedule

Small companies may want to use Excel template spreadsheets to organize an accounts payable aging report manually. Excel AP getting older preparation may end in lacking vendor invoices in the growing older report or incorrect vendor bill numbers, due date info, and calculation errors. As a enterprise proprietor, you’ve in all probability made purchases on your firm on credit before. And when you make plenty of purchases on credit, monitoring how much you owe each vendor could be overwhelming. The growing older strategy of accounts payable entails tracking and categorizing unpaid invoices based mostly on their age since the issue date.

The buy bill could be shared by vendors in a number of methods such as email, ship hardcopy within the mail, fax, and so forth. The payments contain details of products, companies and inventory that you’ve got got bought along with the quantity payable, taxes if any, reductions and the billing and transport details. An Growing Older Schedule is a desk or report that categorizes a company’s accounts receivable (or payable) according to the length of time an invoice has been excellent.

As a critical part of monetary analysis, getting older schedules provide invaluable insights into the liquidity and credit score risk of a enterprise. This, in flip, influences strategic decision-making, from budgeting to investments, and ultimately affects the general monetary well being of the organization. Paying distributors on time helps build trust and makes you a gorgeous customer to do enterprise with.

These internal controls assist you to to forestall paying a fraudulent or inaccurate bill. Also, it avoids situations the place you might pay the vendor twice for a similar invoice. The AP division has to set floor guidelines and processes to follow earlier than making the seller cost. These pointers and management over the accounts payable process are important to keep away from errors triggered as a result of manual work. When you obtain the invoice, you will document it as an accounts payable in your monetary books, because this cash you owe to CDE firm for goods bought on credit score. Gather data on all your outstanding invoices, including the vendors every bill belongs to, the invoice numbers, problem dates, due dates, and amounts owed.

Every vendor or supplier has their very own row that features the entire you owe and how much the debt is late, if relevant. The Accounts Payable Getting Older Report is a cornerstone for effective monetary administration, offering invaluable insights into an organization’s liabilities and money move status. Accurately creating & regularly reviewing this report can forestall https://www.simple-accounting.org/ overdue funds, optimize monetary planning, and strengthen vendor relationships.

This report strengthens their position and helps construct mutually useful relationships with suppliers. Consumer advisory –The data offered on this web site is for common informational purposes solely. We encourage all customers to conduct their own impartial research and due diligence before making any selections primarily based on the information provided right here. For specific advice associated to any matter, please seek the assistance of a qualified skilled. Once the acquisition bill is acquired, it’s assigned internally for processing. AP managers need to verify and examine it towards the purchase order sent to the seller.

Leave a Reply